Request To Pay Solutions

What is Request To Pay Solutions

Request To Pay Solutions is an exciting new service brought about by the Faster Payments Initiative of the FedNow ™ US Federal Reserve providing payments that are instant, final (irrevocable - "good funds") and secure.

Real-Time instant payments, are defined simply as: Irrevocably collected funds in a bank account and usable immediately by the owner of the account. Our "Good Funds" payment gateway allows for instant real-time digital payments that are immediate, irrevocable, intra-bank and/or interbank account-to-account (A2A) transfers that utilize a real-time messaging system connected to every transaction participant through all U.S.-based financial institutions. Funds are available for use by the receiver and real-time confirmation is provided to both you ("the sender") and receiver in seconds. Most Good Funds transactions are "Credit Push" versus "Debit Pull."

Integrating Request to Pay (RTP) solutions with accounting software platforms like QuickBooks Online (QBO) and other accounting software allows businesses to streamline invoicing and receive funds through FedNow and Real-Time Payments (RTP). Here's how such a solution might function:

- Invoicing Integration with QBO/QuickBooks:

- Businesses create invoices within their accounting software platforms (such as QBO or QuickBooks) as they normally would, specifying the details of the transaction, including the amount owed, due date, and payment terms.

- The accounting software integrates with the RTP solution to offer additional payment options, including FedNow and RTP.

- Notification and Payment Options:

- Once an invoice is generated, the accounting software sends notifications to customers, informing them of the invoice details and providing payment options.

- Customers receive notifications via email, SMS, or through the accounting software's customer portal, with instructions on how to proceed with payment.

- Request to Pay (RTP) Option:

- Customers are presented with the option to pay using the Request to Pay (RTP) feature, which allows them to make instant payments through FedNow or Real-Time Payments (RTP).

- Customers can select their preferred payment method, including FedNow for immediate settlement or RTP for real-time payments.

- Payment Initiation:

- Upon selecting the RTP option, customers initiate the payment process directly within the accounting software platform.

- For FedNow payments, funds are transferred instantly between the customer's and business's accounts.

- For RTP payments, funds are also transferred in real-time through the RTP network.

- Confirmation and Reconciliation:

- Once the payment is successfully processed, both the customer and the business receive confirmation through the accounting software platform.

- The accounting software automatically updates the invoice status and records the transaction details, ensuring accurate reconciliation and accounting.

- Integration with Business Systems:

- The RTP solution seamlessly integrates with the accounting software platform, allowing for automated invoice generation, payment processing, and reconciliation.

- Businesses can access comprehensive reporting and analytics through the accounting software platform, providing insights into payment trends and cash flow management.

By integrating Request to Pay solutions with accounting software platforms like QBO and QuickBooks, businesses can offer customers a convenient and efficient way to make payments using FedNow and Real-Time Payments. This streamlines the invoicing and payment process, improves cash flow management, and enhances the overall customer experience.

About Request To Pay Solutions

Bank A2A (Account-to-Account) solutions using RfP FedNow Request To Pay can enable businesses and individuals to send and receive payments instantly, with funds typically made available within seconds.

To use Bank A2A RfP FedNow Request To Pay solutions, you will need to have an account with a participating financial institution that offers the service. Once enrolled, you can use the bank's A2A solution to initiate a payment to another individual or business that is also enrolled in the service.

To initiate a payment, you will typically need to provide the recipient's FedNow Service alias, which can be an email address, phone number, or other unique identifier registered with the service. The bank's A2A solution will then use the FedNow Service to transfer the funds in real-time to the recipient's account.

Bank A2A RfP FedNow Request To Pay solutions can offer businesses and individuals a secure, fast, and convenient way to send and receive payments, without the need for cash or checks.

Features & Benefits

FedNow instant payments has benefits for all parties involved in

Financial Transactions.

Benefits to your company include:

Money Transfer: Current limit of $500,000.

Money Transfer: Current limit of $500,000.

It's Fast: 24/7/365 access to funds anytime vs.

several days for paper checks or ACH transfers to process.

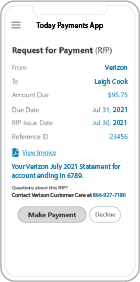

Request for Payments ( RfP ™): Mobile & Online Real-Time Bill Payments.

It's Final: All RTP and Instant Payments are Final & Irrevocable.

Software Integration: Integrate your Management

or Enterprise software with us.

Message Detail: Full 145 characters available

using ISO 20022 messaging XML format.

Online Down Payments: Don't use inconvenient

and expensive Wires & Cashier's Checks.

Online Real-Time Reporting: Configured

Dashboard with Virtual Terminal login.

Reduced calls / emails in the "Purchasing Chain": All

parties to a instant payment transaction receive immediately

text & email messaging.

The

FedNow and RTP Systems enables Participants to initiate credit transfers,

receive final and irrevocable settlement for credit transfers,

and make available to Receivers funds associated with such

credit transfers in real-time, twenty-four (24) hours a day,

seven (7) days a week, fifty-two (52) weeks a year. All instant payments are "Credit

Push" instead of "Debit Pull."

Today Payments

...continues to meet the challenge of our clients by offering cost effective "good funds", real-time, instant, credit card, ACH and e-invoice payment processing services into the electronic payment solutions banking system. Electronic banking includes the transfer of funds between companies (B2B) and/or (B2C) consumer accounts for collection and payments. Today Payments Gateway Merchant Services gives your company choices in the method of faster payments that you can accept from your customers.

Our payment processing platform is designed for simplicity and ease-of-use.

SecureQB Cloud payment processing integration for QuickBooks ® give you the Best transaction detail information, real-time, with matching error-proof through QuickBooks.

Process with the Request To Pay Solutions Professionals

- Automation of Accounts Receivable Collection with Real-Time Settlement & Deposit

- Automation of Accounts Payable Payments with Real-Time Settlement & Deposit

- One-Time & Recurring Real-Time Credits with Settlement & Deposit

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.

Contact Us for Request To Pay Solutions payment processing